When questioned about how optimistic or pessimistic they felt about certain aspects of the future, a marked proportion of survey respondents said they had negative feelings.

A combined 59% of respondents said they felt either ‘pessimistic’ or ‘very pessimistic’ about future government policy settings in their country, while 34% viewed the financial stability of their institution in the same way.

The findings are taken from the responses of 150 senior leaders in the international education space primarily in the UK, Canada, Australia and New Zealand, who were questioned on how their higher education institute viewed internationalisation and how optimistic they are about the future of the sector.

Presented in Cambodia at the Navitas Business Partners Conference 2024, the data is the result of the Global Survey of International Education Leaders 2024 – launched jointly by The PIE, Nous Group and Navitas last month to understand emerging trends in the market.

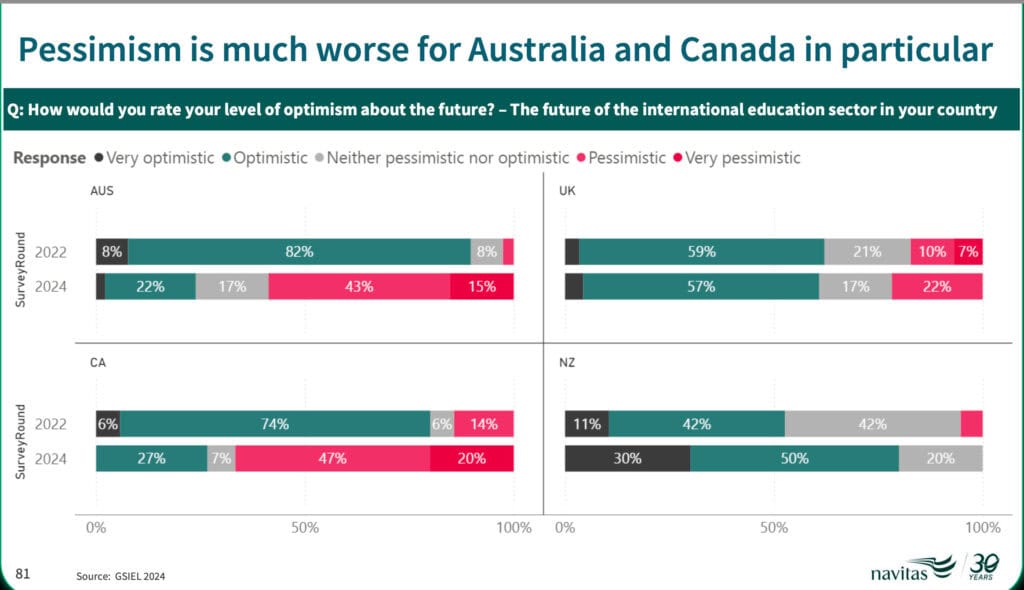

There were striking differences between the ways in which respondents from different countries viewed the future of international education in their region – and a noticeable shift in how those feelings had changed over time.

Photo: Navitas

For example, 58% of respondents from Australia rated their level of optimism about the future of the international education sector in their country as either ‘pessimistic’ or ‘very pessimistic’.

It marks a huge change from results of the same survey in 2022, when a whopping 82% said they felt ‘optimistic’.

Similarly, 67% of Canadian respondents said they were either ‘pessimistic’ or ‘very pessimistic’ about the future – up from just 14% who said they were ‘pessimistic’ in 2022.

The results come amid a grim policy background in both countries. In Australia, the controversial ESOS Amendment Bill has been recommended to pass by the Senate Committee in a recent report, and stakeholders now await the Bill being debated by Senate. If passed, the legislation would see new international student enrolments capped at 270,000 from 2025.

Meanwhile, Canada has further constricted its existing international student cap and revealed new PGWP criteria.

Focusing on what we want to achieve as institutions in the interim, we’ve got to be a lot more policy aligned and try to guess where the government will go

Jon Chew, Navitas

Revealing the findings to delegates, Navitas chief insights officer Jon Chew said: “There are some implications here around whether as institutions we can continue to be market and institutionally aligned and outward looking. Focusing on what we want to achieve as institutions in the interim, we’ve got to be a lot more policy aligned and try to guess where the government will go.”

The survey also revealed that respondents predict their higher education institution is likely to pull back on the amount it invests in recruiting international students in the coming years.

Photo: Navitas

Some 15% said they anticipated their university would invest at a ‘lower’ level into agent aggregators and digital recruitment platforms in the next one to two years, while 7% predicted this investment would be ‘much lower’.

Meanwhile, 11% of respondents said they thought their university would put a ‘lower’ amount of investment into agent commission and incentives, and 13% believed there would be a lower investment into growing international student numbers from countries where the institution was under-represented.

The post Restrictive policies drive outpouring of pessimism in major markets, data reveals appeared first on The PIE News.