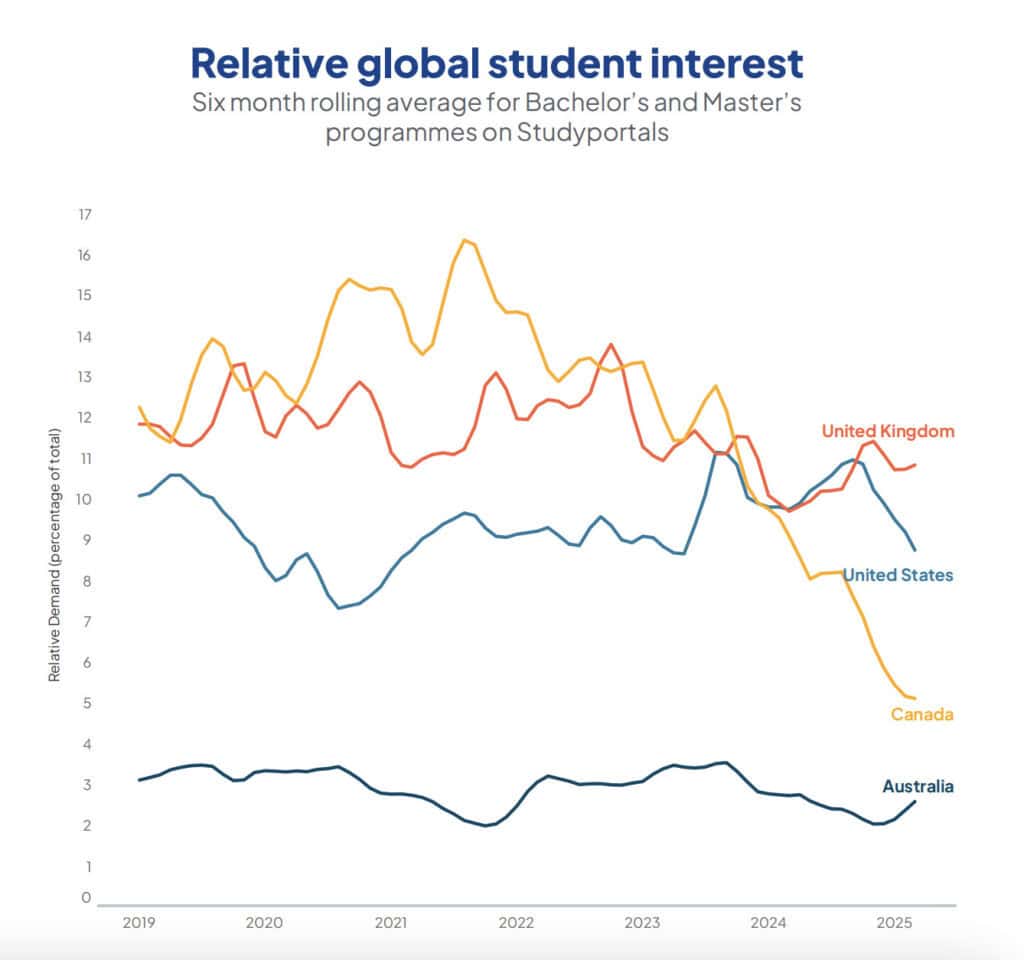

The findings show international students increasingly turning away from the US, Canada and Australia, and could signal an end to the decades-long dominance of the ‘big four’ trading market share, the report by Studyportals, NAFSA and Oxford Test of English suggests.

“For the first time, we’re seeing the big four’s collective market share shrink, and that market share being captured by non-big dour destinations,” said Studyportals head of communication, Cara Skikne.

The research offers near real-time data on student enrolment for the January – March 2025 intake, from 240 institutions across 48 countries.

It highlights a clear divergence in global enrolment trends, with international postgraduate students – who represent most international students – increasingly turning towards the UK, Europe and Asia amid restrictive policies in the US, Canada and Australia.

The sharpest decline in postgraduate enrolment was seen across Canadian institutions, reporting a 31% drop. Universities in the US and Australia both reported a 13% decline, though student interest in Australia on Studyportals saw an 8% rise.

By contrast, the UK saw an 18% rise in postgraduate enrolments this year, rebounding from a sharp drop after the UK government’s dependants ban in January 2024.

The undergraduate landscape was similarly mixed, with enrolments down by a third in Canada, modestly higher in Asia and Australia, and remaining stable in the US and UK.

Notably, 62% of institutions found restrictive government policies and visa issues to be significant, with universities in Canada (93%), Australia (86%) and the US (70%) feeling they were significantly impacting students.

Meanwhile, only 6% Asian institutions felt these were significant issues.

“Universities across the globe mentioned visa costs and delays, migration limitations and policy uncertainty as major obstacles,” explained Skikne.

“They also spoke to the lack of consultation and the disruptive manner in which government policies were rolled out,” she added.

The impact of restrictive government policies is far from over; we expect them to continue casting a long shadow over international enrolments

Cara Skikne, Studyportals

In Canada, 2024 was dominated by successive federal policy changes and study permit restrictions, with international students also at the centre of heated political debates in Australia.

In the US, the consequences of the Trump administration’s attacks on international education are already playing out, with the 13% decline in postgraduate enrolments for the January to March intake likely to be the beginning of a much larger shift.

Since January 5, the US has lost 36% of its market share for master’s degrees on Studyportals, which provides an indication of future trends as students typically begin researching study options 12 to 18 months before enrolling, Skikne explained.

“If current policies remain unchanged, the enrolment decline in the US is likely to deepen,” she warned.

According to NAFSA CEO Fanta Aw: “The message is unmistakable”.

“International students are paying attention – and increasingly turning away from the traditional ‘big four’ destinations in search of stability, opportunity, and affordability.

“If higher education leaders and policymakers fail to act, they risk losing not just talent, but also the innovation, research, and economic vitality that international students generate,” said Aw.

And the destinations gaining students?

Outside the ‘big four’, European countries such as Germany, Italy, The Netherlands, France and Sweden have attracted the most student interest, with relative interest in France, Austria, Ireland and Spain surging between 20-30% over the past year.

Elsewhere, Malaysia, Japan, China, South Korea, the UAE and South Africa have also gained market share, according to the survey.

Meanwhile, budget cuts are expected by most institutions in Canada (67%), Australia (64%) and the UK (57%), with many bracing for staff layoffs as universities grapple with the financial repercussions of enrolment volatility.

Across the board, diversification into new markets was identified as the most anticipated strategy in the face of global political uncertainty, which stakeholders say is only set to continue.

“The impact of restrictive government policies is far from over; we expect them to continue casting a long shadow over international enrolments,” said Skikne.

“At the same time, institutions are being pushed to achieve more with fewer resources, juggling ambitious enrolment targets amid tightening budgets and shrinking teams,” she added.

After diversification, institutions highlighted expanding online programs, the increased use of AI and large changes to programs and subjects – particularly in the UK and Canada – identified as expected trends for the coming year.

The post Survey reveals continued decline of the ‘big four’ appeared first on The PIE News.